India Life Insurance Corporation Form 311 1996-2026 free printable template

Show details

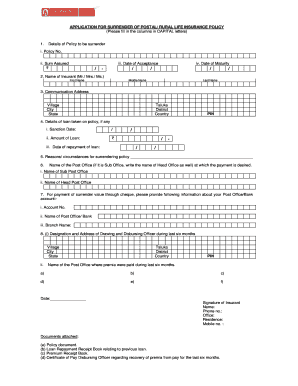

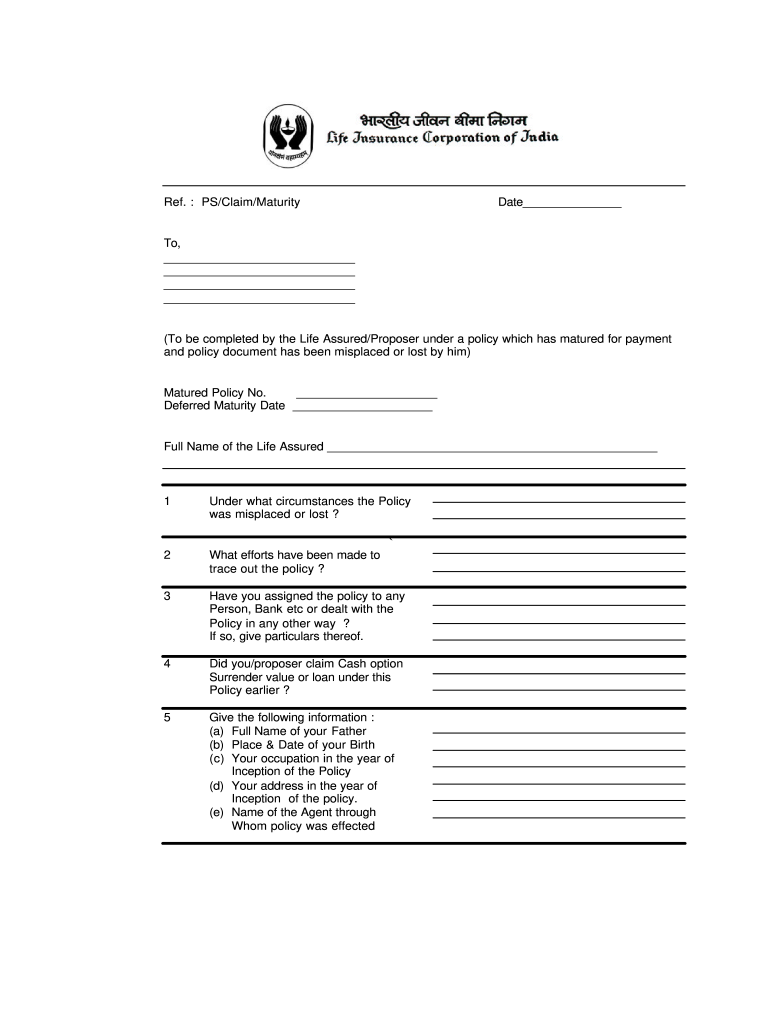

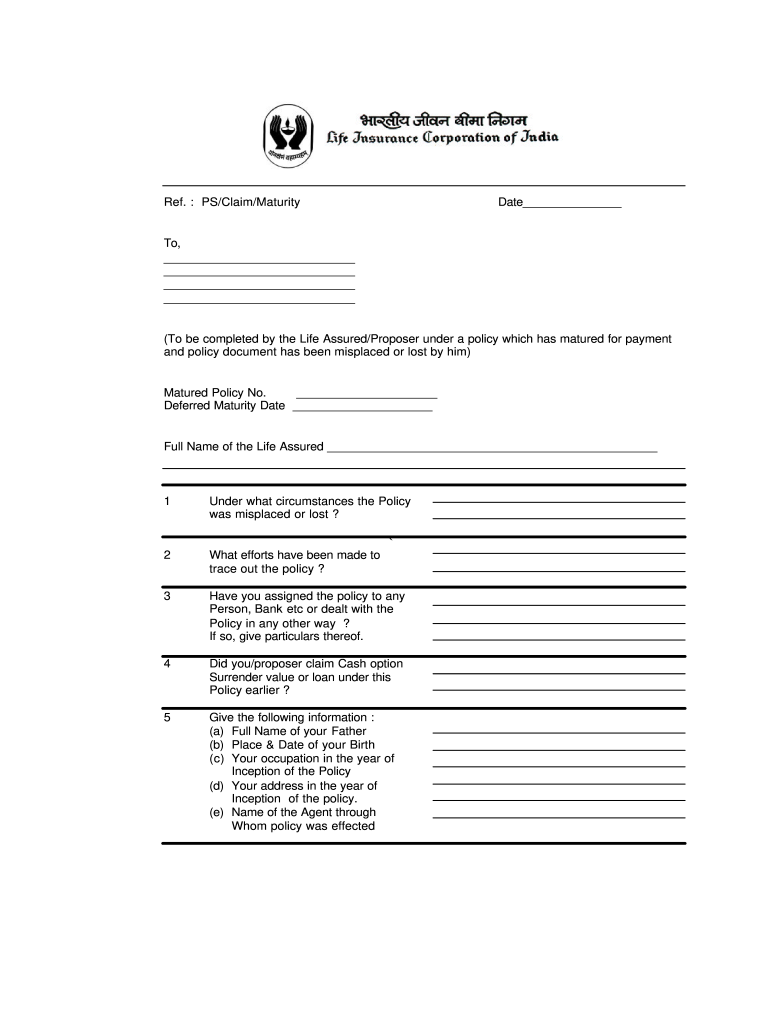

Ref. PS/Claim/Maturity Date To, (To be completed by the Life Assured/Proposer under a policy which has matured for payment and policy document has been misplaced or lost by him) Matured Policy No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign the policyholder can follow the download the policy bond form

Edit your you must submit an indemnity 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how can i download lic download the policy bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is the form for on non judicial stamp paper online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lic policy bond lost affidavit format pdf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

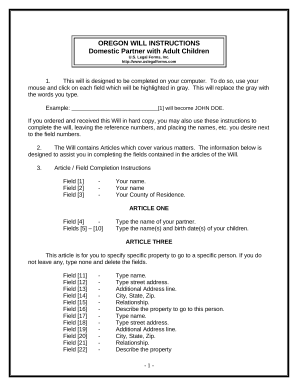

How to fill out lic bond missing letter format

How to fill out India Life Insurance Corporation Form 311

01

Begin by gathering all necessary documents, including identification proof, age proof, and any existing policy documents.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in personal details such as your name, address, and contact information in the designated sections.

04

Provide details regarding the insurance policy you are applying for, including the policy number and type of coverage.

05

Enter information about the insured person, including age, occupation, and health status if applicable.

06

Carefully review the declarations and terms mentioned in the form.

07

Sign and date the form where required.

08

Submit the completed form along with any necessary documents to the relevant LIC office.

Who needs India Life Insurance Corporation Form 311?

01

Individuals seeking to apply for a new life insurance policy with the India Life Insurance Corporation.

02

Existing policyholders who wish to make changes or updates to their current insurance coverage.

03

Beneficiaries wanting to claim benefits from a life insurance policy.

Fill

lic bond paper

: Try Risk Free

People Also Ask about lic duplicate policy bond form

How to fill Form No 3815?

Follow the step-by-step instructions below to eSign your lic form 3815 in english: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

What is the indemnity bond for loss?

As per Section 124 of the Indian Contract Act of 1872, an Indemnity bond refers to an agreement between two persons or parties, where one person promises to make payment for the losses and damages of another person caused by his/her conduct or by another party.

How to download policy bond online?

How to get duplicate LIC policy bond online? No, LIC has no procedure to issue a duplicate policy online. You would physically need to visit the nearest LIC branch and request a duplicate policy bond.

How can I download LIC bond?

The policyholder can follow the below steps to download the document: Visit the LIC Website. The first step to download the LIC Policy Bond online is to visit the official website of LIC, .licindia.in. Login to Your Account. Access the Policy Bond. Download the Policy Bond.

How do I get my original policy bond?

Since the LIC policy bond is a legal document, you need to submit an indemnity bond for applying for a duplicate copy. For preparing this indemnity bond, request for a form 3756 from LIC and print it on a non-judicial stamp paper. Confirm from LIC about the value of the stamp paper, which may vary from state to state.

What is the form for lost LIC policy bond?

You must submit an indemnity bond in order to request a duplicate copy of the LIC policy. You will have to request form 3756 from LIC and take its printout on non-judicial stamp paper. The cost of the stamp paper should be verified with LIC as it may differ from one state to another.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete lic bond paper pdf download online?

pdfFiller makes it easy to finish and sign lic bond online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit original lic bond paper straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing lic bond paper download, you need to install and log in to the app.

How do I fill out the lic bond paper image form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign lic indemnity bond and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is India Life Insurance Corporation Form 311?

India Life Insurance Corporation Form 311 is a regulatory form used by life insurance companies in India to report specific financial information and policy details to the Insurance Regulatory and Development Authority of India (IRDAI).

Who is required to file India Life Insurance Corporation Form 311?

All life insurance companies operating in India are required to file Form 311 with the IRDAI as part of their compliance and reporting obligations.

How to fill out India Life Insurance Corporation Form 311?

Form 311 should be filled out by providing accurate financial data, policy details, and other required information as specified in the guidelines issued by the IRDAI. Companies must ensure all fields are completed fully and correctly before submission.

What is the purpose of India Life Insurance Corporation Form 311?

The purpose of Form 311 is to ensure transparency and compliance in the insurance sector by providing regulators with critical data regarding the financial health and operations of life insurance companies.

What information must be reported on India Life Insurance Corporation Form 311?

The form must report information such as premium collections, claims paid, policyholder data, investment performance, and other relevant financial metrics that reflect the company's operations and performance.

Fill out your India Life Insurance Corporation Form 311 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lic Bond Paper Lost is not the form you're looking for?Search for another form here.

Keywords relevant to lic bond lost affidavit

Related to lic policy document

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.